Waiting for the dole

The cold calculus of not acting on unemployment insurance in the middle of the pandemic

Thank you for subscribing to Health and Capital. I’m enormously appreciative of the comments and feedback I’ve gotten, and for the first paid subscribers to my posts. As I’ve written elsewhere, this project is still very much getting its footing so for the time being I want to make sure to keep posts free and accessible to anyone who might find them valuable. As the project evolves I’ll try to solicit information on what people would like to see from subscriber-only content, and try to be open and transparent when I introduce paywalled posts.

Today’s post is a particularly reactive one. If federal pandemic unemployment assistance expires, many people will fall into poverty. As far as the social determinants of health go, the single act of neglecting to renew this program will be an epidemiologic event all its own.

[Image description: Krusty the Klown speaks with labor leader George Meany. Subtitle reads “Let me be blunt. Is there a labor crisis in America today?”]

On this week’s public episode of Death Panel, we had a short discussion about the material implications of Congress passing what has been signaled as a follow up to the CARES Act. The respective majority leaders have quite publicly staked out their terms and what’s there isn’t much to write home about. If McConnell’s key terms are broad liability protections to limit employer responsibility for their workers’ coronavirus deaths or illness, and Pelosi’s key terms are expanding OSHA, then both parties clearly have a single goal: force people back to work.

For better or worse much of the coming week will be about this fight. While it’s arguable that watching the affairs of Congress with any granularity is only to collect self-evident proof of the system’s flaws, the particularities of one of the items on the week’s agenda may be a useful indicator for just how much worse American governance could yet become. I’m referring to one of the biggest will-they-won’t-theys set to expire in the CARES Act: the extension of federal pandemic unemployment compensation.

A lot has been written about pandemic unemployment insurance this month, so there are a variety of other places you could go to understand what it is and why failing to extend it would be a disaster. What I will say is that, in the absence of passing significantly better legislation like Pramila Jayapal’s Paycheck Guarantee Act (or Jayapal’s other coauthored solution for that matter: “minting the coin”), there are now more than 32 million people on unemployment in the US. The only real way to read this is as a self-inflicted wound, particularly when you compare our actions with other countries that passed state funding to keep workers at home receiving their regular paycheck, instead being laid off or otherwise risking their lives to remain at work. Instead, Congress failed upward into what I assume is one of the most unintentionally popular policies in modern history: the $600/week pandemic unemployment boost. This is set to expire July 25th.

Until recently it appeared that the final compromise would be to reduce this federal unemployment boost from $600 to something like $200-300. On the aforementioned Death Panel episode, we warned that this would be insufficient: many of the people collecting the $600/week federal unemployment assistance are likely depending on it to be able to even afford their rent or mortgage, at a time when millions are already likely to be evicted and become unhoused. It is also almost certainly supporting people’s ability to buy groceries, PPE, or really anything at all, in the middle of an economic crisis that principally comes out of an immediate drop in consumer demand. For some, it has quite literally demonstrated that America’s default class position—head held under the water of debt—is arbitrary and capricious:

[Image description: Screenshot from twitter user reading “I’ve been furloughed since mid-March and don’t have a return date yet. As a family of 4, that $3400 plus another $1200 weekly plus state UI means that for the first time in DECADES, we have enough to pay all our bills and have money left over. DECADES.”]

[Image description: Screenshot from twitter user reading “Pretty telling that I was unemployed for nearly 3 months & am now only back part-time, but this is the first time in my life that I haven’t had to juggle bills & have been able to set aside more than a couple hundred bucks in savings.”]

This is not to say the program is perfect, or even a particularly good way to handle economic assistance during a pandemic. Much like what I said about Medicaid in a previous post, our unemployment system itself is an odd patchwork of different implementations at the state level. As anyone who has applied for unemployment will know, most of these implementations are explicitly geared towards making it difficult to get on unemployment at all, and yet more difficult still to remain on unemployment week to week.

Finally, there is no real reason for unemployment to not be an entirely federally managed and funded program. This isn’t even some weird leftist belief, this is quite literally a recommendation spelled out by the likes of the RAND Corporation. With that being said, this is the path Congress elected to take and it would be an unmitigated disaster to remove it without replacing it with equal (or ideally stronger, more universal) support during the pandemic.

Doing nothing

While extending UI at the $200-300 level would be far from ideal, a very different narrative has since emerged. It now appears that Congress is likely to allow the added benefits to expire:

This is what I want to try to understand in the remainder of this post. It’s one thing to tease out what would happen if benefits were extended at a lower rate. It’s another to look at what happens if benefits are not extended at all, as Nathan Tankus did very well earlier this month. But what happens if Congress allows them to expire, only to act a few weeks later to re-implement them at or below the previous level of assistance? And, maybe more importantly: why do this?

It’s been no secret that neoliberals are ideologically opposed to these benefits. Almost immediately, think tanks were crowing that these unemployment benefits would slow economic recovery by making being unemployed pay better than holding a minimum wage job. Mainstream press echoed this logic, including the widely panned story from NPR’s Morning Edition in April that promoted one business owner’s perspective that the unemployment benefits were the reason she could not keep her coffee shop staffed. That story cited and ideologically parroted the business owner’s blog post, where she had written that pandemic unemployment benefits had been enacted in order to “provide a lifestyle of a $60,000 annual salary to those who are unemployed during the pandemic” (emphasis mine). This logic is frustrating but has an enduring and simple solution, which is to not allow for a political economy in which people can be expected to work at poverty wages.

If we operate under the assumption that inaction on extending unemployment might drive people back into the labor market, we can see why they might do this. (Maybe not see how you could do this at a moral level, but that doesn’t seem to be a factor here). If we assume that many of the people living on enhanced unemployment at the moment may not be able to sustain themselves or their families if it was suspended, we could assume they may be forced to try to find work. Arguably, since it can be proven that substantial indeterminacy in the federal response to COVID-19 pushed states to reopen faster, its reasonable to think that Congress projecting indifference towards the lives of millions may have a similar effect at the individual level.

A big problem with this is, as even conservative economists have pointed out, many of the jobs lost in the first months of the pandemic were permanent job losses, in positions that are not expected to come back. A more fundamental problem with this is that the incentive here doesn’t appear to just be some flimsy ideological debate over the inherent patriotism of work. It’s more likely that Congress simply wants the unemployment percentage to go down, whether because they think it makes them electorally vulnerable or because high unemployment figures unfavorably into the U.S.’s GDP calculation.

But this all begins to sound a bit like a retread of some well-worn arguments. Stepping back for a moment, most of this discourse appears to ignore some fundamental contextual features of this debate.

First, the initial inclusion of the $600/week addition to unemployment was more or less a miracle. While people have spoken about it as though it was slipped in at the last moment, I simply think it tells us a lot about the immediate concerns and understanding within Congress at the time of passage. Recall that the CARES Act was passed in a moment where some public officials were projecting the crisis would amount to a few weeks of shutdown. (Whether this was a result of being in denial or because the state has shed an unprecedented amount of public health officials in the last decades, it’s hard to be sure).

What this suggests to me is that Congress assumed that the pandemic wouldn’t be as big a deal as it has become, would not last this long, and would not effect the economy as dramatically as it has. With this in mind, Congress passing such enormous support as $600/week in additional unemployment benefits makes a lot more sense to begin with: they didn’t think as many people would need it as ultimately have. This is why I earlier characterized their actions as having “failed upward.”

A new challenger approaches

Since, in open defiance to basic facts, we seem to be in a similar moment of denial about our ability to push forward with re-openings I’m going to assume Congress may be acting with a similar mindset again. Congress might drag their feet to let pandemic unemployment payments lapse, taking the gamble that it will push people to seek work. Terrible as it is, it might even be correct. Considering how steady the clip of new unemployment claims has been since the beginning of the pandemic, if the number of new weekly unemployment claims falls below 1 million for the first time they may see this as confirmation bias for the conclusions reached by NPR’s coffee shop owner and by The Heritage Foundation alike. This may even be the idea—allow a lapse to create a data point, to seemingly prove it.

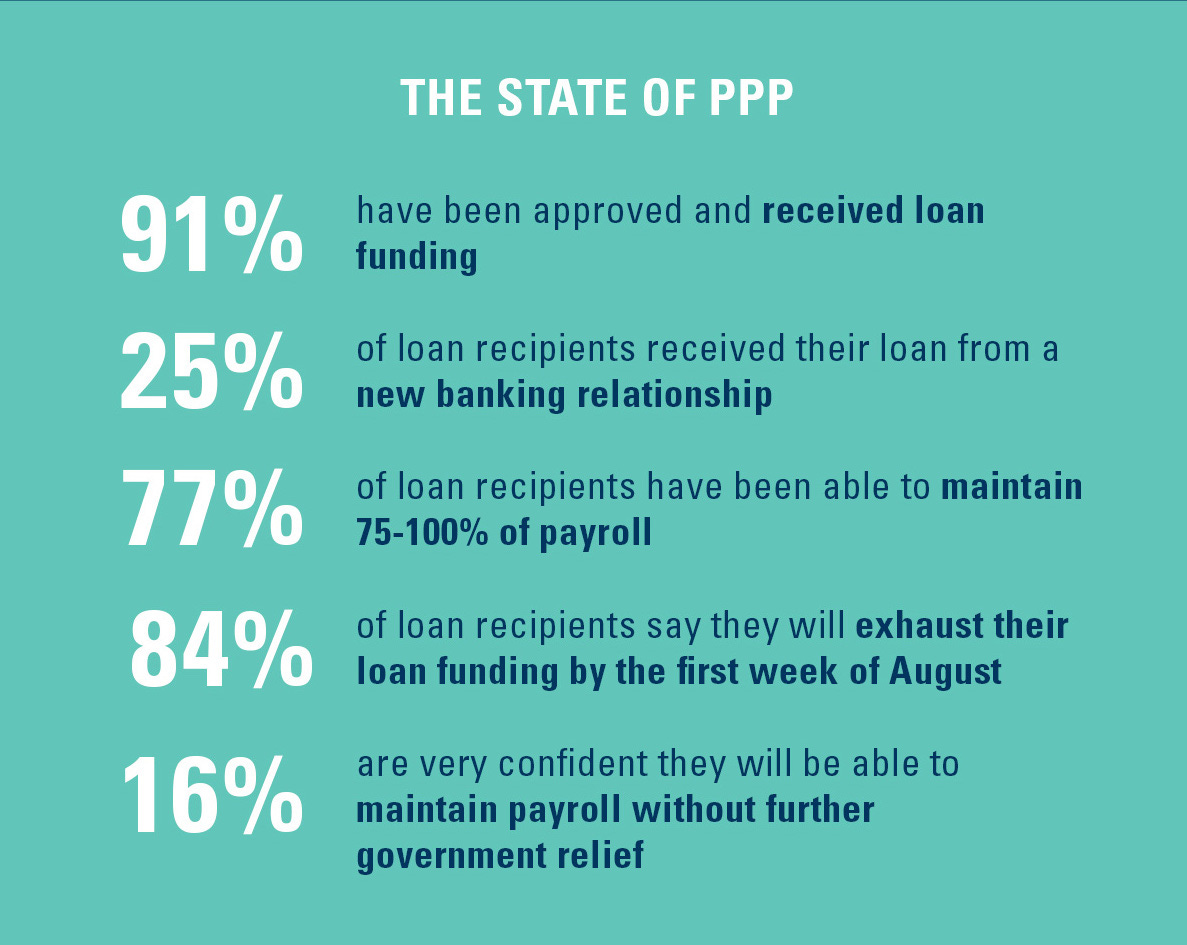

But there’s one important factor that would be missing here, and it suggests Congress hasn’t been a good student of its own actions. Last week, on Bastille Day, Goldman Sachs released the results of a survey it conducted on businesses receiving Payroll Protection Program (PPP) loans. The PPP has been the subject of a lot of its own fights and wrangling. Though much of the public discourse around it focuses on the seeming hypocrisies created by the wealthy people who got loans (who, exactly, do people think own businesses in the first place?), it has certainly helped some private entities retain their employees. That is, as long as the loans hold out.

[Image description: Infographic from Goldman Sachs report “The State of PPP — 91% have been approved and received loan funding — 25% of loan recipients received their loan from a new banking relationship — 77% of loan recipients have been able to maintain 75-100% of payroll — 84% of loan recipients say they will exhaust their loan funding by the first week of August — 16% are very confident they will be able to maintain payroll without further government relief ]

The Goldman Sachs report contains this rather staggering statistic: of businesses surveyed, about 84% say they will exhaust their loan funding by the first week of August.

This means that, for all the (warranted) public outcry over the possibility that federal pandemic unemployment assistance could expire, the job market Congress expects people to jump back into will probably be considerably worse by early August, based on this alone. Add to this that states have quietly been rolling back re-opening plans. So some businesses that had planned to reopen just in time for their PPP loans to run dry won’t be able to. For example, some museums in New York received PPP loans. Since the U.S. doesn’t have free, state-funded museums, they rely mostly on other sources of funding. With PPP loans only able to help so much and for so long, and with Gov. Cuomo stating museums won’t yet be allowed to go ahead with their expected reopening plans, expect even more layoffs in a sector already rife with them.

It’s always possible Congress will act at the last possible moment to extend the $600 unemployment benefits. It’s even possible, if improbable, that eventually they’ll understand the pandemic as a moment that requires a complete realignment of the state’s management of the political economy. But passing a pandemic unemployment extension, or even minting the coin, is at best a band-aid. As my collaborator Phil Rocco wrote this week, “Nothing less than a reconstruction will do.”

Thank you for reading Health and Capital. As I mentioned in my introductory post, if you enjoyed this and would like to support my ability to produce future posts, please subscribe, share links to it, tell me what you think, and become a patron of the Death Panel on Patreon. Death Panel is a podcast I co-host with Beatrice Adler-Bolton, Philip Rocco, and Vince Patti, and if you enjoy Health and Capital you will probably enjoy it as well.